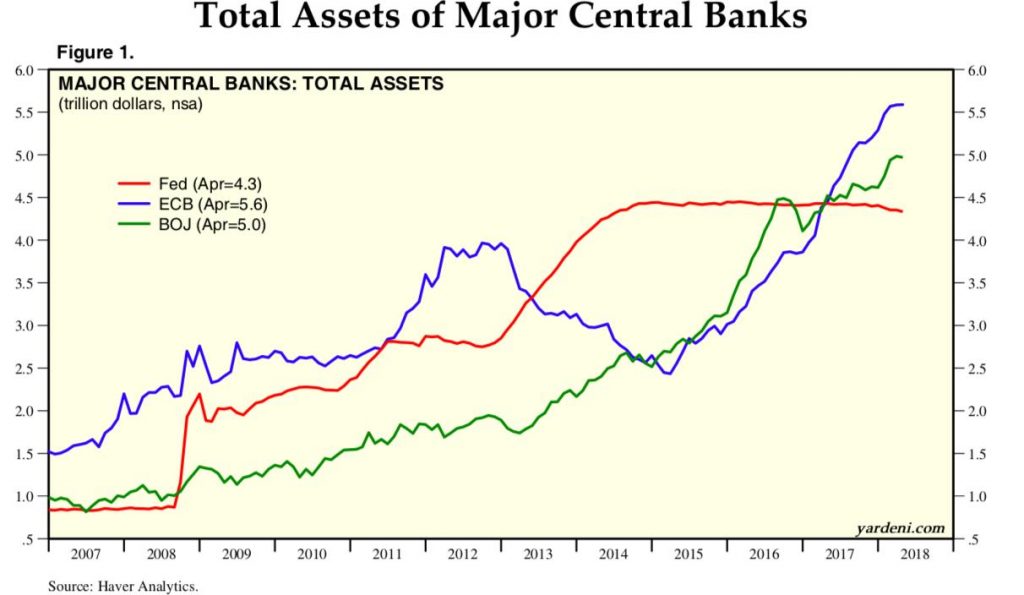

The stock market is at its all-time high with the S&P 500, Dow Jones at roughly 3700 and 3100 respectively. But why not? Everything looks just fine! COVID-19 is nothing! It has infected more than 75 million people and killed over 1.5 million only! The Federal Reserve and other central banks around the world have expanded their balance sheets to new levels by printing an enormous amount of money (a good decision with unknown future consequences). A crisis that has cost the global economy millions of jobs. It has widened the gap between the haves and have-nots, but who cares? The stock market is skyrocketing!

Long story short, Let’s look at a few things that make me believe we are in a bubble.

1- People are gambling in the stock market: People are buying and selling tickers (not businesses) using their own money and the free money received by the government. This phenomenon is not exclusive to the United States only, it applies to Europe where I live and potentially elsewhere. An investor is someone who invests money in a business after valuing it based on its fundamentals. Speculating on the other hand is the buying and selling of tickers based on prices. “Just looking at prices is gambling, not investing”. – Warren Buffet. Even worse, buying and selling decisions are based on tips from others (presumably better-informed speculators). A friend of mine bought a bankrupt company without even understanding what chapter 11 means!

Also, according to an article published on Yahoo! finance, 43% of retail investors are trading with leverage, Why not YOLO!

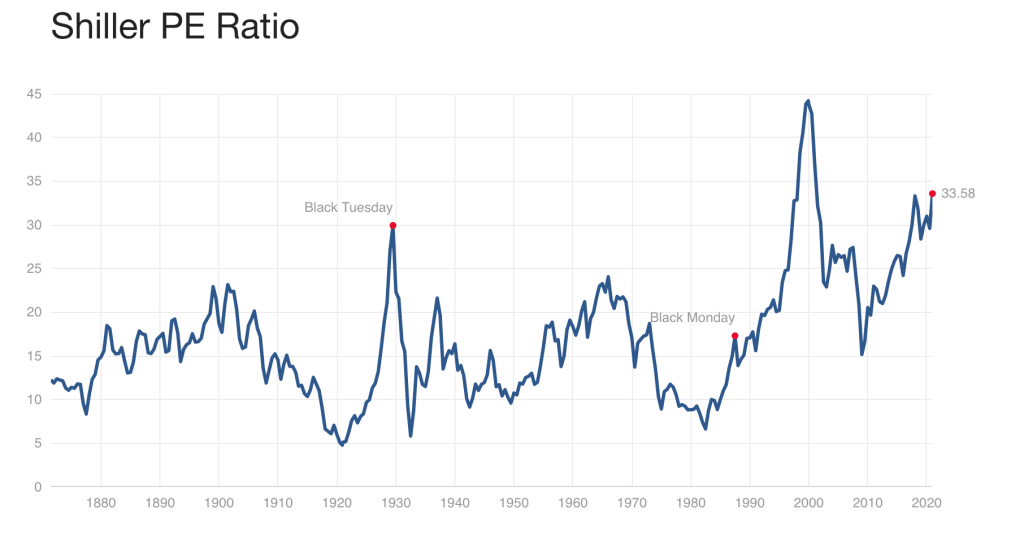

2- The Shiller CAPE Ratio which is defined as price divided by the average of ten years of earnings, adjusted for inflation and is used by investors to see whether the stock market is overpriced or underpriced and extrapolate future returns based on historical averages is currently above 33 which is higher than the S&P 500 historical average of roughly 17.

3- Emotions, emotions and emotions: CNN’s well-known Fear and Greed Index which indicates whether the market is dominated by fear or greed shows us that greed and extreme greed have been in play for a year now! From a historical perspective, a big theme for bubbles has been the absence of rationality and the dominance of emotions.

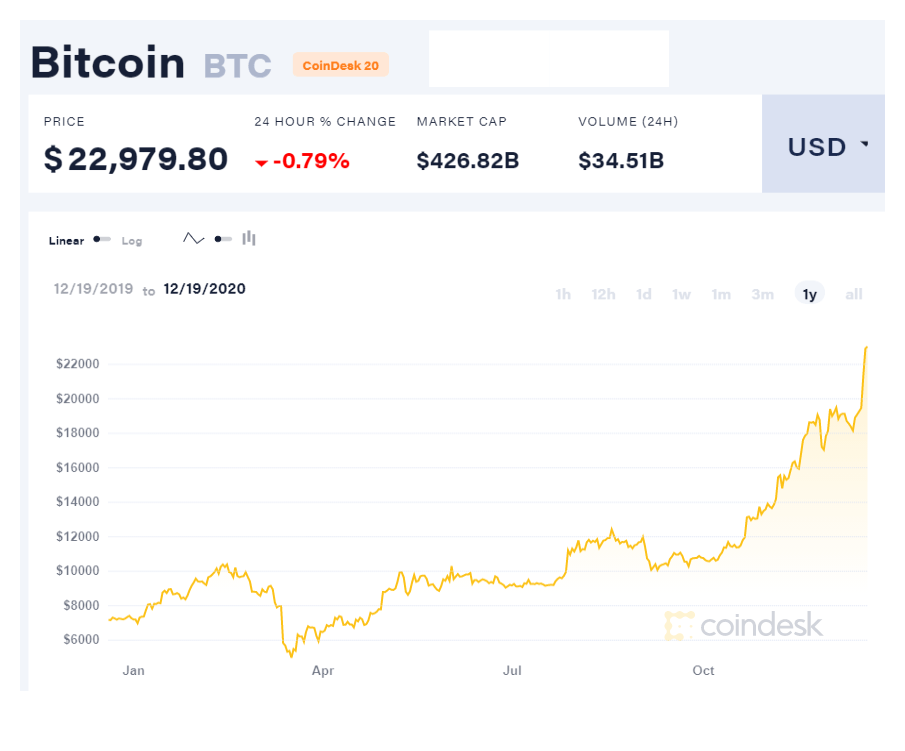

4- Crypto mania has reached a new level: The cryptocurrency frenzy refuses to surrender and keep attracting more money into it. Don’t get me wrong, I am all for Blockchain Technology, but neither I nor anyone I presume can value cryptocurrencies! The herding behavior in the crypto space is obvious since I am almost asked on a daily basis by people whether they should buy cryptocurrencies or not which makes me believe that people are suffering from FOMO!

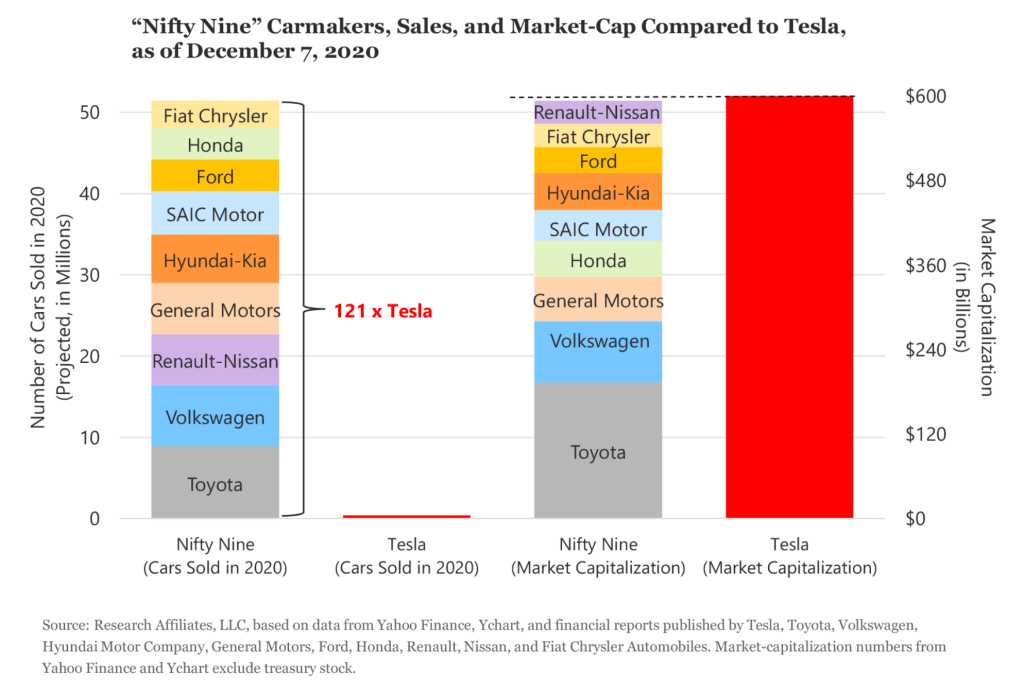

5- Companies are selling at ridiculous valuations:

Tesla’s Market Cap is just absurd: Again, people will think that I don’t like Tesla, etc. I don’t have a problem with Tesla, but I have a problem with the valuations. Tesla’s market cap is equal to or larger than the 9 biggest auto companies in the world combined, despite the fact those 9 firms have sold 121x more cars than Tesla has in 2020!! Essentially, people are saying that no one will compete with Tesla in the future (to me this is beyond comprehension).

Zoom, a company that benefited from the stay at home theme caused by the pandemic is selling at a crazy price: I still don’t understand why a company with no economic moat (sustainable competitive advantage) competing against Cisco WebEx, Microsoft teams, Google meet, Skype and many other products should be valued at over 100 billion dollars. If someone knows, please enlighten me!

There are many examples out there but I just wanted to mention two as an illustration:

Conclusion:

First, this an abbreviated list of why I think the stock market is in a bubble. Second, while I am sure that many retail investors will survive to become successful investors in the future, the vast majority will suffer losses! And it’s not their fault only! It’s the fault of those trading apps offering commission-free trading which are getting people addicted (just like social media). Also, bubbles can last years (the tech bubble lasted 5 years 1995-2000) and it’s extremely difficult if not impossible to know when it will burst. Finally, I want to remind everyone that I am just a newbie with some common sense and that investing is a long-term endeavor that is dependent on the probability of survival. As Howard Marks says: “There are old investors, and there are bold investors, but there are no old bold investors.”

Wishing everyone Happy Holidays.

Michael