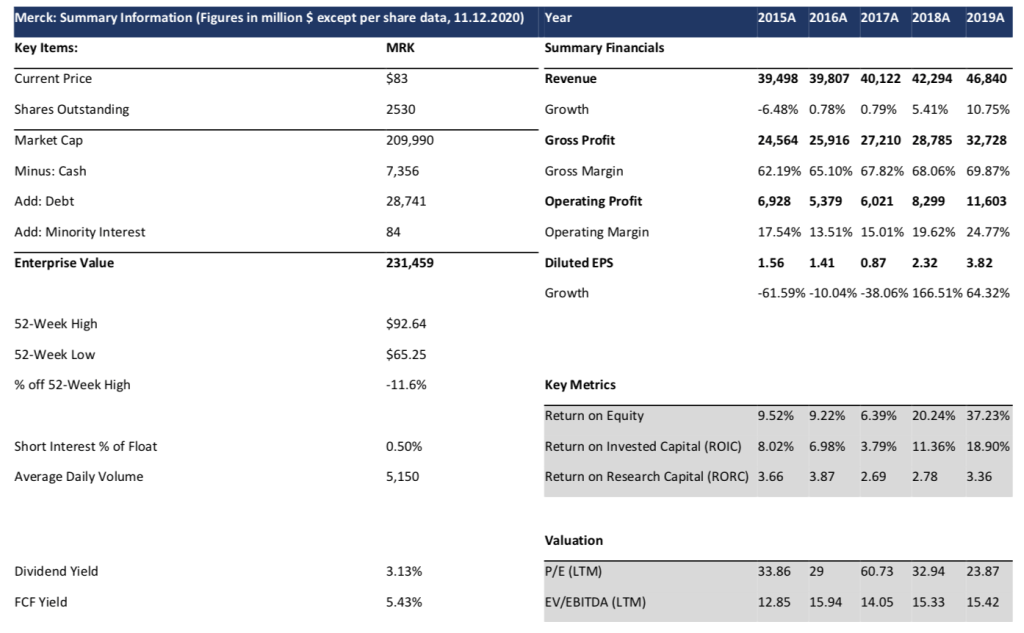

Merck & Co Inc. is a BUY at $83 (18 times earnings) given that I expect the business to compound at 10% (including dividends) annually through late 2024. Shares at this level allows the long-term investor to pay a price below fair value for a mega cap pharmaceutical company. Merck’s growth in oncology, vaccine and animal segments combined with its operating leverage should grow earnings at a high-single digit rate in the next five years.

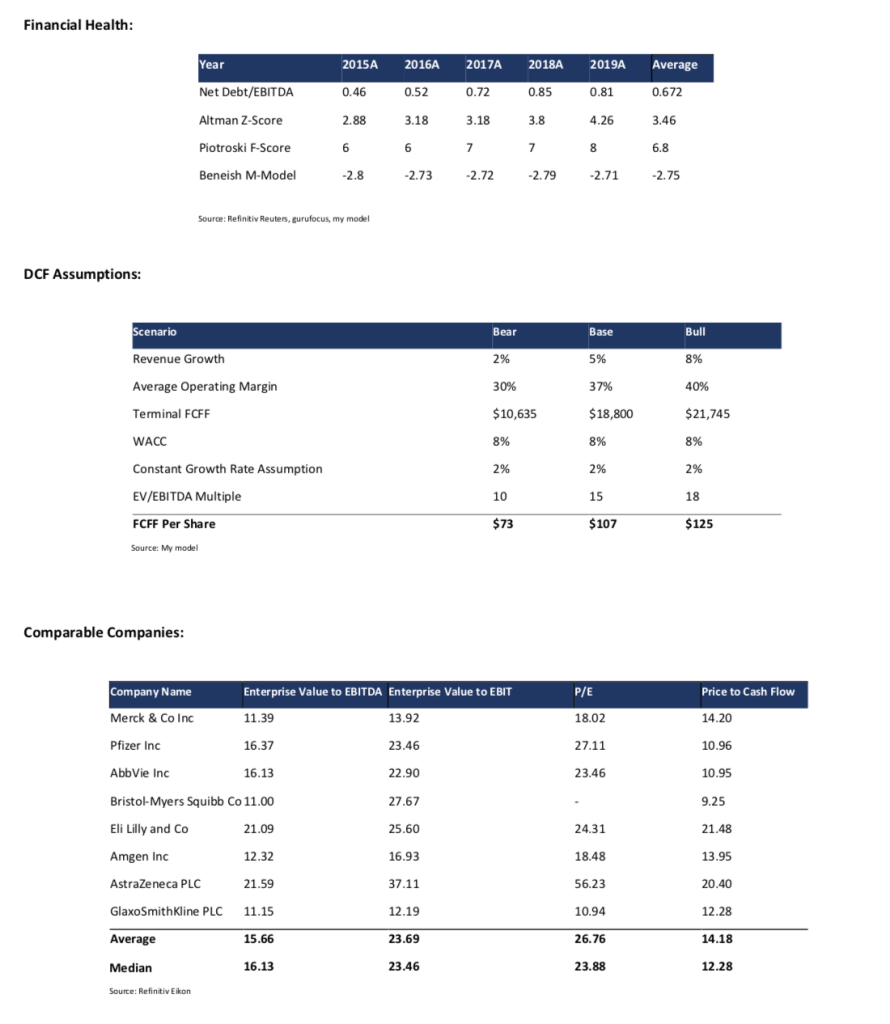

My base case valuation has Merck & Co Inc. valued at ~ $107 vs $83 as of December 11, 2020 – representing a 29% return. I believe that the risk reward attractive given that in my bear case scenario of $73 an investor doesn’t lose much (12%) yet can make over 50% in my bull case scenario of $125.

Investment Thesis:

My investment thesis has two key points

1- Wide Moat and Large Addressable Population

2- Attractive Economics and Expanding Margins

1- Wide Moat and Large Addressable Population:

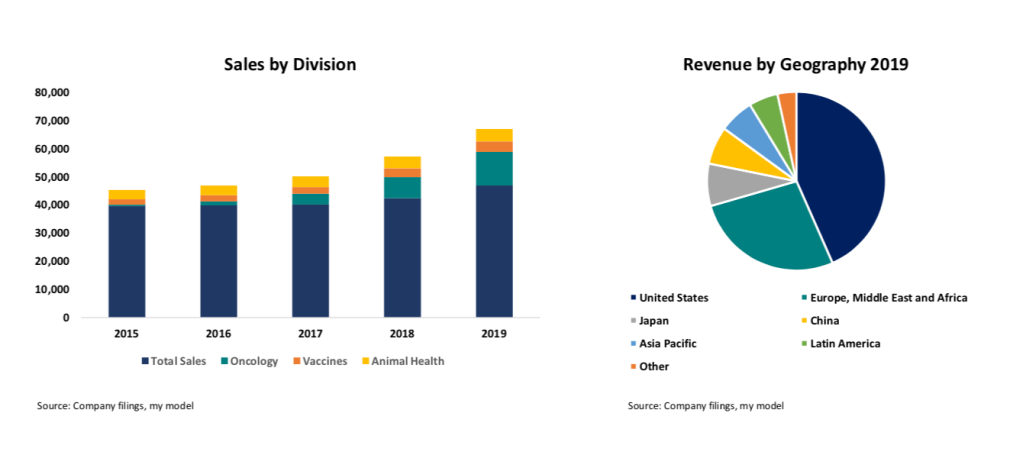

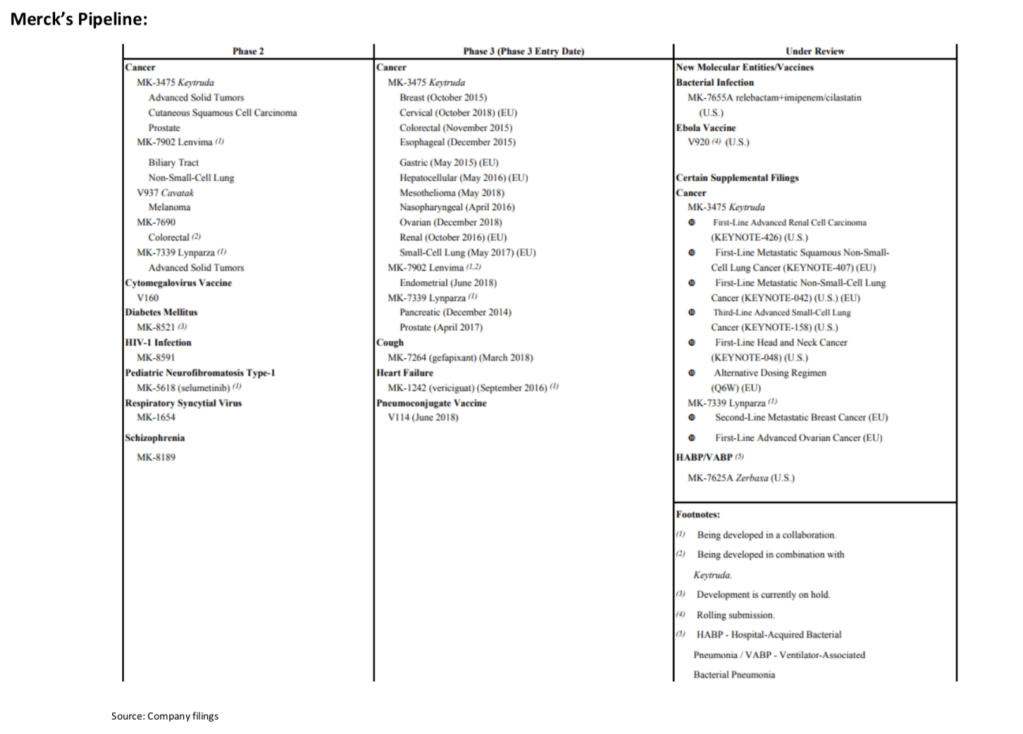

Merck is an Oncology leader: Merck’s immunotherapy drug Keytruda (pembrolizumab) which helps the immune system identify and destroy cancer cells was approved back in late 2014. Keytruda can be used as a monotherapy or in a combination with other drugs and/or treatments such as chemotherapy and radiation. Today, Keytruda is the 2nd bestselling drug in the world brining over $10 billion in revenue during the first 9 months of 2020. In 2018, there were 17 million new cases of cancer worldwide among which 2.1 million were lung cancer cases according to the World Health Organization (WHO). Keytruda is a leader in lung cancer treatment and is also being used in 17 other indications such as skin, head and neck, liver, kidney, bladder, etc. Merck has announced that 50% of the drug’s sales in the first 9 months of 2020 came from indications other than lung cancer during the last conference call with analysts. Keytruda has grown at 80% CAGR during the last five years and is expected to become the world’s best- selling drug in the next few years. Analysts expect Keytruda sales to top 24 billion in 2024. Besides Keytruda, Merck’s strategic partnerships with AstraZeneca Plc on Lynparza (olaprib) a drug to treat ovarian cancer, fallopian tube cancer, etc. and Eisai Co., Ltd on drug Lenvima (lenvatinib mesylate) used for thyroid cancer, advanced kidney cancer, and liver cancer have started to yield results growing at 54% and 65% CAGR respectively over the last two years. The two drugs now bring roughly $1 billion dollars in sales to Merck. According to a report by Mckinsey, oncology therapeutics accounted for $143 billion in 2019 (20% of global pharmaceutical sales) and is expected to grow at a 12% CAGR through 2024 to reach $250 billion which should help Merck’s oncology business tremendously. Moreover, Merck has been active in the M&A market in order to complement its internal research capabilities. The company acquired VelosBio, Inc. a clinical-stage biopharmaceutical company committed to developing first-in- class cancer therapies) for $2.7 billion and announced a collaboration with Seagen Inc. for 600 million upfront payment and 1 billion in equity investments to develop and commercialize s ladiratuzumab vedotin (MK-6440), a clinical trials Phase 2 drug for breast cancer and other solid tumors.

Vaccine and Animal Health growing at a steady rate: Merck’s vaccine division hosts several well-known names such as Gardasil and Gardasil 9 forHuman papillomavirus (HPV). According to data from the Centers for Disease Control and Prevention (CDC), between 2013 at 2017, about 45,300 HPV related cancers occurred in the United States alone each year. The vaccine sales have grown at 14% CAGR over the last five years and brought $3 billion in sales during the first 9 months of 2020 and I expect it to reach $5 billion in sales in 2024 – compounding at 8% CAGR through that date as more people become aware of the benefits of getting vaccinated against HPV and more governments/NGOs launch vaccination programmes. Also, Merck’s pediatric vaccines ProQuad, M-M-R II and Varivax against (Measles, Mumps, Rubella and Varicella Virus Vaccine Live) have grown at 9% CAGR between 2015 and 2019 exceeding $2 billion in sales. Pneumovax 23 which is another vaccine for pneumococcal diseases has also done 11% CAGR in the last five years and should exceed $1 billion in sales in 2020. Merck is the 3rd largest animal health pharmaceutical company in the world with 10% market share. Sales are divided between the livestock and companion animals’ segment. The division brought $4.4 billion in sales in 2019 and has grown at 5.7% CAGR over the last five years. As per the report published by Fior Markets, the global animal healthcare market is expected to grow from $46.8 billion in 2019 to $72.92 billion by 2027, at a CAGR of 5.7% during the forecasted period 2020-2027. Merck’s growth in the last five years is in line with the forecasted percentage growth for the industry and thus, I expect the animal division sales to match at least the projected percentage increase and exceed $5 billion in sales in 2024. Also, Merck has made a few important acquisitions in this space such as IdentiGEN which leads the world in DNA traceability. the company pioneered the use of this technology to improve food traceability and supply chain transparency. DNA analysis has become the next step in providing retailers and processors with assurances about origin and product claim.

2- Attractive Economics and Expanding Margins

• Expanding margins will boost profitability: The gross margin of a company tells us a great deal about the quality of a business. Merck’s gross margin has expanded from 62% in 2015 to reach 72% in the first nine months of 2020 based on a better revenue mix combined with a greater pricing power for its drugs. Merck’s operating margin shows us the quality of its management which initiated a global restructuring plan to rationalize its resources and so far, has managed to increase operating margin from 25% in 2019 to 29% during the first 9 months of 2020. Merck’s growth in Operating Profit (EBIT) has outperformed growth in revenue by 4% roughly from 2015 to 2019 and I expect the company’s operating margin to be 33% for 2020. Beyond that, the 2021 expected spinoff of the company’s women’s health brands, legacy and biosimilars products into new company Organon & Co. whose sales should total $6.5 billion in 2020 will make Merck a more focused company and is expected bring more than $1 billion in operating efficiencies by 2024. Also, EBITDA is expected to be up at 41% for 2020 vs 33% in 2019. The company’s measures of profitability have gone up since 2017 with Return on Equity (ROE) reaching 37% and the Return on Invested Capital (ROIC) 19% in 2019. High margin drugs and cost reductions should ensure strong expansion in the next five years in both the ROE and ROIC respectively.

Competition:

The pharmaceutical industry is highly competitive. In 2019, pharma revenues worldwide totaled $1.25 trillion. Merck competes with many well-established firms in the industry such as Johnson & Johnson, Roche, Pfizer, Bayer, Novartis and many others for market share and talent. The oncology market is even more attractive to market players due to its higher margins. Merck’s oncology drug Keytruda is a market leader and accounts for 30% of Merck’s sales. There are a few other immunotherapy drugs on the market. Brystol-Myers Squib’s Opdivo is a Keytruda’s closest competitor with over $7 billion sales in 2019. However, the dispersion between Keytruda and Opdivo is getting bigger and bigger with the former outperforming the latter by 30% CAGR over the last five years. On September 21st, a new data showed that Keytruda doubles 5-year survival rate for lung cancer patients (50% of the drug’s sales come from lung cancer as previously mentioned). “I think it’s tremendously encouraging for patients that are facing a lung cancer diagnosis to be able to think about living for five years or longer from the time they’re diagnosed,” Scot Ebbinghaus, Merck VP of clinical research, said. “If you look at the percentage of patients who actually finished two years of therapy with Keytruda … 80% of those patients were alive at five years, and about half of those patients had not required any subsequent therapies,” he said. Another competitor could be Switzerland’s Roche drug Tecentriq (atezolizumab). The drug gained approval back in 2019 and brought $1.3 billion in sales for the company in the first half of 2020. Tecentriq is seen as a drug that would replace Opdivo as the 2nd player in the industry, but not Keytruda because of the latter’s substantial head start and demonstrated survival benefit over 5 years + horizon. On the vaccines’ front which accounts for 7 billion in sales for Merck, Gardasil and Gardasil 9 are market dominants with over 95% share in the HPV market. The two vaccines brought $3.7 billion in sales for Merck in 2019. The only other vaccine approved for HPV is GlaxoSmithKline’s Cervarix whose sales have been flat at around $180 million.

Valuation:

The value of a business is the value of its cash flows over its lifetime discounted at an appropriate discount rate to present. I have built a DCF model with three scenarios in mind. Base, bull and bear case scenarios. My base case scenario has the company valued at $107 based on 50/50 DCF with terminal growth rate of 2% and 15 times EV/EBITDA exit multiple (15 times is in line with Merck’s average EV/EBITDA for the last 5 years and also in line with the average EV/EBITDA for its competitors). Keytruda is a blockbuster that I expect to grow at 14% CAGR (outperforming the growth in the oncology market by 200 bps yearly) through late 2024 to reach 25 billion in Revenue. The company revenue should grow at 5% CAGR through late 2024 to reach $62 billion. Operating margin will increase from 33% for 2020 to reach 40% in 2024. My bull case scenario yields a price of $125 based on 50/50 DCF with terminal growth rate of 2% and EV/EBITDA exit multiple of 18. My bull case scenario assumes a top line growth rate of 8% CAGR consistent with management’s expectations for year 2020 had Covid-19 hadn’t happen. Margin expansion is factored in in this scenario and operating margin kept 40% consistent with Management target after the spinoff of women’s health, trusted legacy and biosimilar products. My bear case scenario assumes revenue growth of only 2% (effectively inflation) which is below the company’s growth for the last 5 years of 3.5% CAGR. Operating margin levels at 30%, Merck’s is priced at $73 in the bear case scenario based on a 50/50 DCF with terminal growth rate of 2% and EV/EBITDA exit multiple of 10. All scenarios (base, bull and bear) assume a WACC of 8% (pumped up from 6.4%) to increase my margin of safety. Also, all scenarios assume a 21% tax rate except for this year. Merck’s dividend yield has averaged 3% in the last five years. The company’s share buyback has over $6 billion left and should be resumed after it was discontinued back in March. I expect Merck’s stock price to compound at 10% CAGR (including dividends) through late 2024. The company generates more than enough cash flow ($13.5 billion in 2019) to support a powerful salesforce for current and future drugs as well as it can cover the $1 billion average research and development cost to bring a new drug to the market, meet its financial obligations, buyback stock and pay dividends.

Risks and Mitigants:

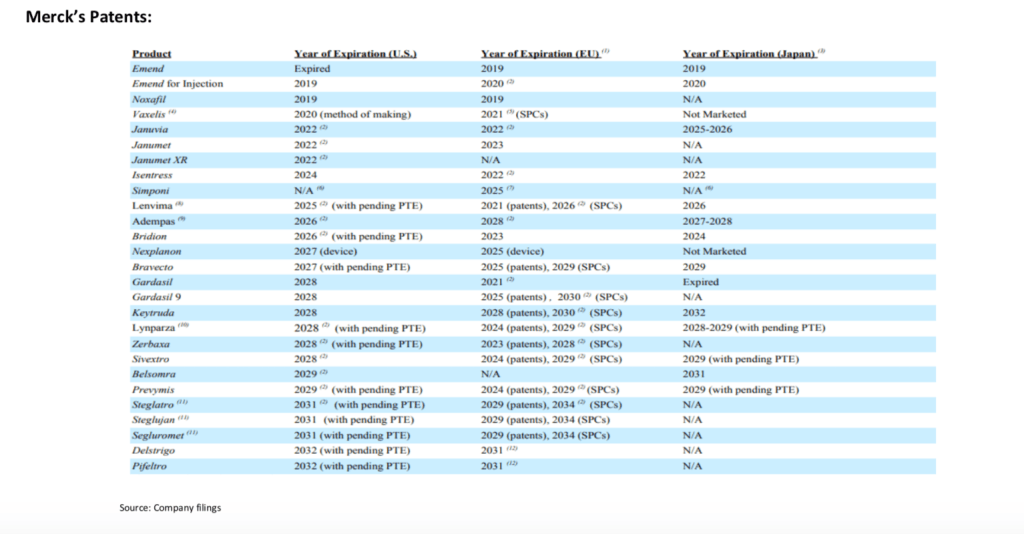

- Januvia/Janumet Patent Expiration: Merck’s diabetes drugs’ Januvia (Sitagliptin)/Janumet (Sitagliptin and metformin HCI) have had a great positive impact on the company’s sales over the years reaching $5.5 billion in sales in 2019. Patents for both drugs will expire in 2022/2023 and generic competition is going to enter the market and erode their market share. However, I think that Merck’s revenue increase in oncology and other segments should offset the impact that generic competition will have on Januvia/Janumet sales.

- Revenue Concentration: Merck’s oncology division is growing revenue fast and has reached 30% of sales in the first 9 months of 2020. Merck’s oncology drugs have patents that extend until 2028 plus it is the 3rd largest spender on R&D in the industry after J&J and Roche and has 60 drugs in its research pipeline across all Phases. This is the single biggest risk, but the combination of the previous 2 points should put investors at ease.

- Legal Risk: Merck faces some remaining legal risk with Vioxx. While most plaintiffs participated in the $5 billion settlement, a few surprise outcomes could require additional settlements. Also, litigation risk remains from patients who took one-time blockbuster Fosamax for osteoporosis as the medicine has been linked to infrequent but serious side effects. Merck has set aside $250 million as a reserve for legal settlements and I believe that the company management’s view on the matter led by CEO Kenneth Frazier; a lawyer who directed the defense against Vioxx should be adequate.

- CEO Succession: Kenneth Frazier is 65 years old and has already agreed to stay beyond 2019 as the Company’s CEO after the company scrapped a policy requiring its CEO to retire at the age of 65. During the last conference call with analysts, Frazier said that ‘’the board will continue to evaluate the timing of CEO succession’’. I am confident that Merck has some internally strong candidates which the board of directors are considering to lead the company in the future

Management

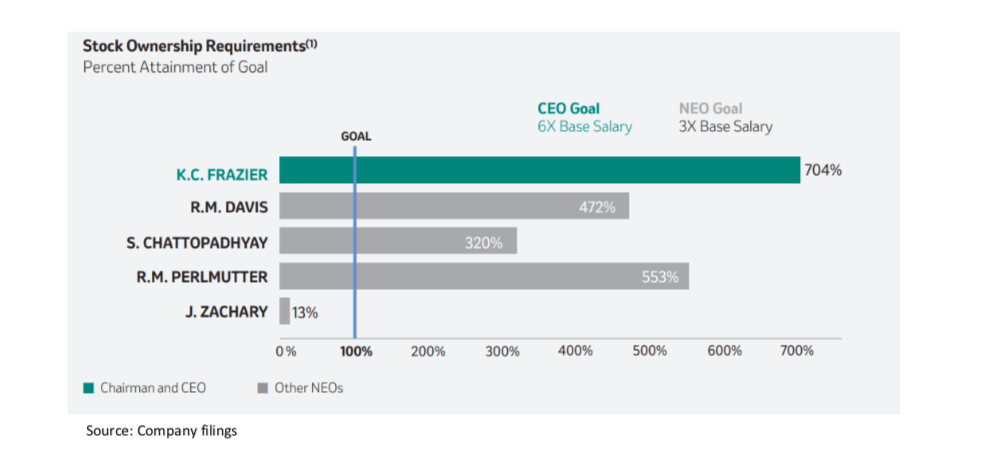

- The company’s board of directors is composed of 12 members with diverse backgrounds from scientific to legal and beyond of whom 11 are independent. The chairman of the board is CEO Kenneth Frazier.

- The company is led by Kenneth Frazier who joined the company back in 1992 as general counsel and has been the CEO since 2011. In 2013, Frazier prioritized research funding over meeting the year’s earnings target (against short-termism). The stock has more than doubled since he was appointed CEO. Frazier holds a JD from Harvard.

- Rober Davis is the company’s CFO. He joined Merck in 2016. Prior to joining Merck, Davis worked for Baxter International as vice president and president of medical products and before that he spent 14 years at Eli Lilly & Company where he held numerous positions. Davis holds a JD and MBA from Northwestern University.

- Sanat Chattopadhyay is the executive vice president and president of Merck manufacturing division. Sanat joined Merck in 2009 as senior vice president of global vaccines and sterile manufacturing operations. Sanat holds a degree in chemical engineering from Jadavpur University and post-graduate industrial engineering degree from NTIE, India.

- Roger Perlmutter serves as executive vice president and president of Merck research labs. Before joining Merck, he worked as head of R&D at Amgen from January 2001 until February 2012. Roger was a professor in the department of immunology, biochemistry and medicine at the University of Washington. Seattle. Roger received his M.D. and Ph.D. from Washington University in St. Louis

- Except for J.Zachary, all management team members hold more than 3X their base salary in company stock.

Appendix:

Business Overview:

Merck & Co Inc. known as MSD outside the United States and Canada is a global pharmaceutical company. It was founded over 125 years ago back in 1891 and is headquartered in New Jersey, USA. Merck’s business is divided into four division namely: Pharmaceuticals, Animal Health, Healthcare Services and Alliances Segments. The Pharmaceutical segment includes human health pharmaceutical and vaccine products. Merck sells its Pharmaceutical products to wholesale distributors, hospitals, physicians, governments, etc. The Animal Health segment discovers, develops, manufactures and markets a wide range of veterinary pharmaceutical and vaccine products. The Company also offers an extensive suite of digitally connected identification, traceability and monitoring products. The Company sells its products to veterinarians, distributors and animal producers.

“Being a value investor means you look at the downside before looking at the upside.” -Li Lu

Disclaimer:

This material is based on current public information that I consider reliable, but I do not represent it as accurate or complete, and it should not be relied on as such. My research is not an offer to sell or the solicitation of an offer to buy any security. It does not constitute a personal recommendation or consider the particular investment objectives, financial situations, or needs of individual investors. Investors should consider whether any advice or recommendation in my research is suitable for their circumstances and, if appropriate, seek professional advice, including tax advice. No part of this material or any research report may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without my prior written consent