Description:

888 Holdings PLC

Investment Summary:

888 Holdings PLC (LON:888) is a Gibraltar-based, London-listed and one of the Big 4 online gaming and betting companies operating in a highly regulated industry with increasing barriers to entry trading at 6x 2023 Earnings and 5x 2023 EBITDA. A string of events from the acquisition of the non-US operations of William Hill using a combination of debt and equity, suspending dividends and exiting the Netherlands to the CEO leaving after a scandal involving some middle eastern clients and the UK gambling white paper on the industry sent to stock tumbling ~65% in a year. However, we believe the company’s predictable revenue stream combined with operating leverage from synergies and optimisation of current operations will boost future margins and the impact of new regulations will boost the company’s market share at the expense of smaller operators and deter new players from entering the market. We believe that shares at this level should allow the patient investor to own a stake in a Big 4 global online betting and gaming operator with an asymmetric Risk/Reward profile of 1/5 over the next 2-3 years!

Source: Koyfin

Business overview:

888 Holdings PLC was founded by two sets of Israeli entrepreneurs Avi and Aaron Shaked and Shay and Rom Ben-Yitzhak as Virtual Holdings Limited in May 1997. The company was listed on the London Stock Exchange in 2005 and the name 888 first appeared in 2006. The company employs more than 11,000 people globally and owns 6 brands namely William Hill, 888casino, 888poker, 888sport, Mr. Green and SI Sportsbook and SI Casino in the US in partnership with Authentic Brands Group. The company receives 90% of its revenue from regulated or taxed markets and reports 3 operating segments: The UK & Ireland online segment which generated £717m (~40%) of the company’s revenues in 2022 with 16% EBITDA margin and over a million average monthly active users. The retail segment represented by William Hill is the 2nd largest in the UK in terms of revenues with more than 1386 shops and contributed £519m of revenue (~28%) with 17.5% EBITDA margin in 2022. The International online segment serves customers in over 100 countries and has top 3 market share (>10%) in Spain and Italy with growth potential in Canada, Denmark, Germany and Africa and contributed £614m (~33%) to company revenues in 2022 with 22% EBITDA margin.

Source: Company filings

Industry Overview:

According to data from H2 Gambling Capital and Statista, the global market size for online gambling is expected to be worth $95 billion in 2023 and expected to growth at 8.54% CAGR through 2027. Europe’s market size is expected to be $43 billion in 2023 representing more than 40% of the global market and is expected to grow by 6%-7% through 2027. The US has the second place with $19 billion expected revenue in 2023 representing 20% market share and is expected to exhibit the fastest growth rate at 12% CAGR through 2027. Canada and Australia are jointly expected to have close to $14 billion in 2023 or 14% of the global market share with an expected growth of 9% and 7% CAGR through 2027 respectively. The industry is fragmented, but barriers to entry and consolidation have been increasing over the last 5-10 years with the biggest players (companies having the scale to spend on technology, compliance, marketing and acquisitions generating over $20 billion in revenue combined per year such as Flutter Entertainment, Entain, DraftKings, 888 Holdings, and Kindred acquiring other smaller operators across different segments from online poker to online and retail sports betting to increase their market share, diversify their revenue stream and achieve better margins through synergies.

Why does this opportunity exist?

A string of events led the stock to drop more than 50% over the course of a year:

- The Netherlands exit: The company exited the Netherlands in October 2021 which had an impact of roughly £36 million or 5% on revenues.

- Leveraged balance sheet: The company completed the acquisition of non-US business of William Hill in July 2022 for £1.95 billion (8x EBITDA) with £584.9m in cash and the rest in a combination of equity and debt issuance leaving the Company’s leverage at 5.6x Net Debt/EBITDA and led the company to suspend its dividend payment.

- CEO stepping down: The company’s CEO Itai Pazner who led the company for almost four years and oversaw the acquisition of William Hill stepped down in January 2022 after some Anti-Money Laundering (AML) and Know Your Client (KYC) processes were not followed for its VIP customers in the Middle East which impacted 3% of revenue initially (now it’s expected at 1.5% instead). The company appointed Lord Jonathan Mendelsohn who was a non-executive chair to act as an interim CEO.

- UK gambling white paper: In May 2023, the UK where over 60% of the company’s revenues are derived introduced the long-awaited updated white paper on on gambling imposing stake limits per spin on slot machines and affordability checks among other restrictions impacting investors view on the industry and company’s future profitability.

Investment Thesis:

- Stable and predictable revenue stream will allow for successful deleveraging: We believe that the company will be successful at deleveraging its balance sheet from 5.6x Net Debt/ EBITDA to below 3.5x or below by 2025. The gambling industry in general is mildly exposed to recessions. Luck-based gambling activities increase during periods of financial distress with people trying out their luck to riches. During the Global Financial Crisis of 2008, 888 was a standalone business and its revenue dropped by ~6% and rebounded back in 2010 whereas the newly acquired William Hill saw its revenue increase by 4% during the same time. On a pro forma basis, the decline in revenue was equivalent to ~2%. The company’s first debt maturity is in 2027 with 50% in GBP, 43% in Euro and 7% in USD. 70% of interest payments for the next 3 years have fixed-rate agreements and every 1% increase in rates would result in 5 million increase in payments. Interest payments are expected to be £168 million in 2023 with an interest coverage ratio of 1.3x. However, we note that the company reduced its marketing expense from 23% of revenue to 18% between 2021 and 2022 reducing the demand driven marketing spending due to regulatory pressures combined with marketing synergies after William Hill acquisition. `We believe the company can flex down the demand driven marketing spending in case revenues drop over the short-term to meet its interest payments and protect margins’.

- Successful integration of 888 and William Hill business will boost margins in the future: The company’s initial synergies estimation was £100 million and was raised to £111 million for 2023 and £150 million cumulatively between Opex and Capex by 2025. EBITDA margins have already increased by 15% YoY and are expected to go above 20% in 2023. Management reiterated the synergy numbers recently in their presentation to investors and on the last conference call.

- International markets represent a significant opportunity to drive revenues: We see the company’s brands SI Sportsbook and SI Casino (a joint venture with Authentic Brands Group) as an important partnership with a well-known US brand to gain market share in the $19 billion US online gambling market. The company has already started operating in both Michigan and Virginia and is expected to roll out services into 2 new states per year. Canada is a $3.5 billion for the company where it obtained a license for operations in Ontario and Launched its services in 2022. The company’s Mr Green brand has the highest market share in Denmark with the potential to gain market share in neighbouring Nordic countries and Germany. Africa has a current online gambling market size of $1.6 billion. The company launched a joint venture brand there and has already ~500K players with both the number of players and stake amounts increasing since October 2022. We see these less mature markets that currently represent 10% of the company’s revenues as an opportunity to grow the company over the next few years offsetting slower growth in more mature markets.

- Regulatory Pressures to boost existing players’ market share and Profitability: Existing major market players in an anticipation of the recently issued UK gambling white-paper voluntarily applied limits on initial staking and max bet sizes per spin on slot machines (£10), increased verification requirements and reduced marketing budgets from last year and included the anticipated effects in their guidance to investors. We believe the new regulations will naturally affect new players negatively and most likely deter them from entering the industry since marketing campaigns and promotional activities are the most common way for new players to gain a foot in the industry and will force smaller players to lose market share allowing the biggest players including 888 to gain market share in those markets and spend less on administrative and marketing expenses which will ultimately result in operating margins expanding.

Valuation:

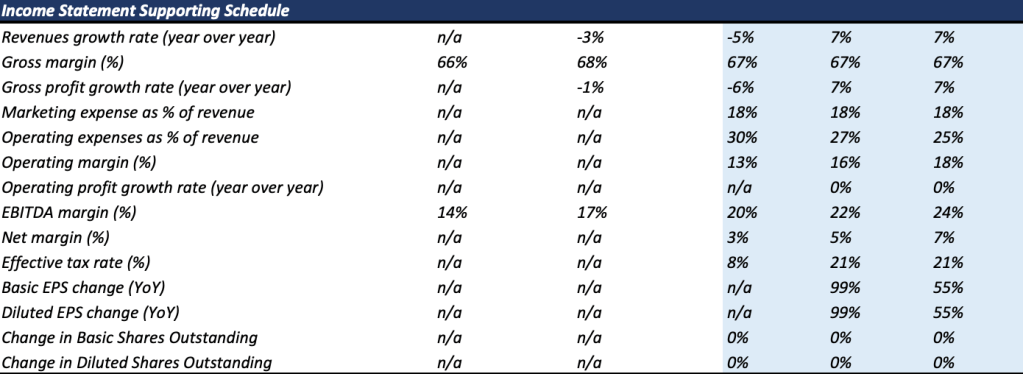

- The stock is currently trading at £0.72 per share which is 6x 2023 Earnings and 5x 2023 EBITDA respectively. This is a significant discount to the company’s historical median valuations of 15x forward P/E and 13x forward EV/EBITDA and more than 50% discount to industry peers (the other big 3) namely Flutter Entertainment plc, Entain plc, and DraftKings. Our base case scenario assumes revenue growth of -5% in line with management guidance and consensus estimates for 2023 and 5% after that driven by a combination of slower growth in core markets and faster growth in optimize and new markets to reach £1.93 billion in 2025 below the management target of above £2 billion. We expect ROIC to reach 12% in 2024 and exceed our WACC of 10% driven by the realization of synergies leading to NOPAT expansion. In addition, Management is expecting FCF to turn positive in 2024. We expect EPS in 2025 to be £0.3 (20% below management guidance). We are applying a justified 12x P/E in 2025 based on Growth Rate and ROIC (lower than the historical median of 17x) to get a £3.6 price per share which represents 500% return based the current market price of £0.72 per share. Our bear case scenario assumes Revenue growth of -5% per year through 2025 more than the combined drop in revenue of 2% during the GFC to reach £1.6 billion in 2025. No successful deleveraging and no flexibility in slashing marketing expenses to get a value of £0 per share. Our bull case scenario is in line with the management guidance of 7% revenue growth in 2024 and 2025 combined with >23% EBITDA margin and 0.35 EPS. We are modeling ROIC close to 15% and applying a multiple of 17x P/E multiple to yield £6 price per share or ~800% return. Applying a 70% weight to our base case scenario and 15% to both the bear and bull case scenario yields a price target of £3.4 in 2025 or a ~500% increase from today’s price. All our scenarios apply a 2% increase in interest rates over the next 2 years. We believe this opportunity offers an attractive Risk/Reward profile for patient investors over the next 2-3 years.

*Insiders have bought more than £350,000 worth of stock since September 2022.

*Founders still own 19% through a trust!

Risks:

Prolonged Recession, worse than anticipated regulatory impact, unsuccessful deleveraging.

Catalysts:

New CEO, Successful deleveraging, ROIC expansion, FCF positive and EPS growth.

Appendix:

Source: My financial model, company filings.

Disclaimer:

This material is based on current public information that I consider reliable, but I do not represent it as accurate or complete, and it should not be relied on as such. My research is not an offer to sell or the solicitation of an offer to buy any security. It does not constitute a personal recommendation or consider the particular investment objectives, financial situations, or needs of individual investors. Investors should consider whether any advice or recommendation in my research is suitable for their circumstances and, if appropriate, seek professional advice, including tax advice. No part of this material or any research report may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without my prior written consent